Web3 Infrastructure

Tokenized value exchange, secure chain orchestration, and compliant on-chain ecosystems for institutional finance.

Bose Capital Group partners with banks, NBFCs, regulators, and global institutions to build secure Web3 rails, modernize financial systems, and activate AI-driven intelligence across complex financial ecosystems.

The global financial landscape is shifting from manual, siloed processes to real-time, transparent, AI-enhanced digital ecosystems. Bose Capital Group engineers the rails and intelligence layers required to operate the future of finance.

Tokenized value exchange, secure chain orchestration, and compliant on-chain ecosystems for institutional finance.

Risk scoring, anomaly detection, liquidity prediction, and deep financial analytics embedded into operations.

Digital banking systems, automation frameworks, and world-class compliance layers built for regulated markets.

Multi-region consulting and operational transformation for regulated banks, NBFCs, funds, and financial institutions.

Predictive intelligence frameworks that convert financial data into real-time decisions across risk, credit, and liquidity.

Compliant blockchain systems enabling cross-border fund movement, asset tokenization, and verifiable transaction flows.

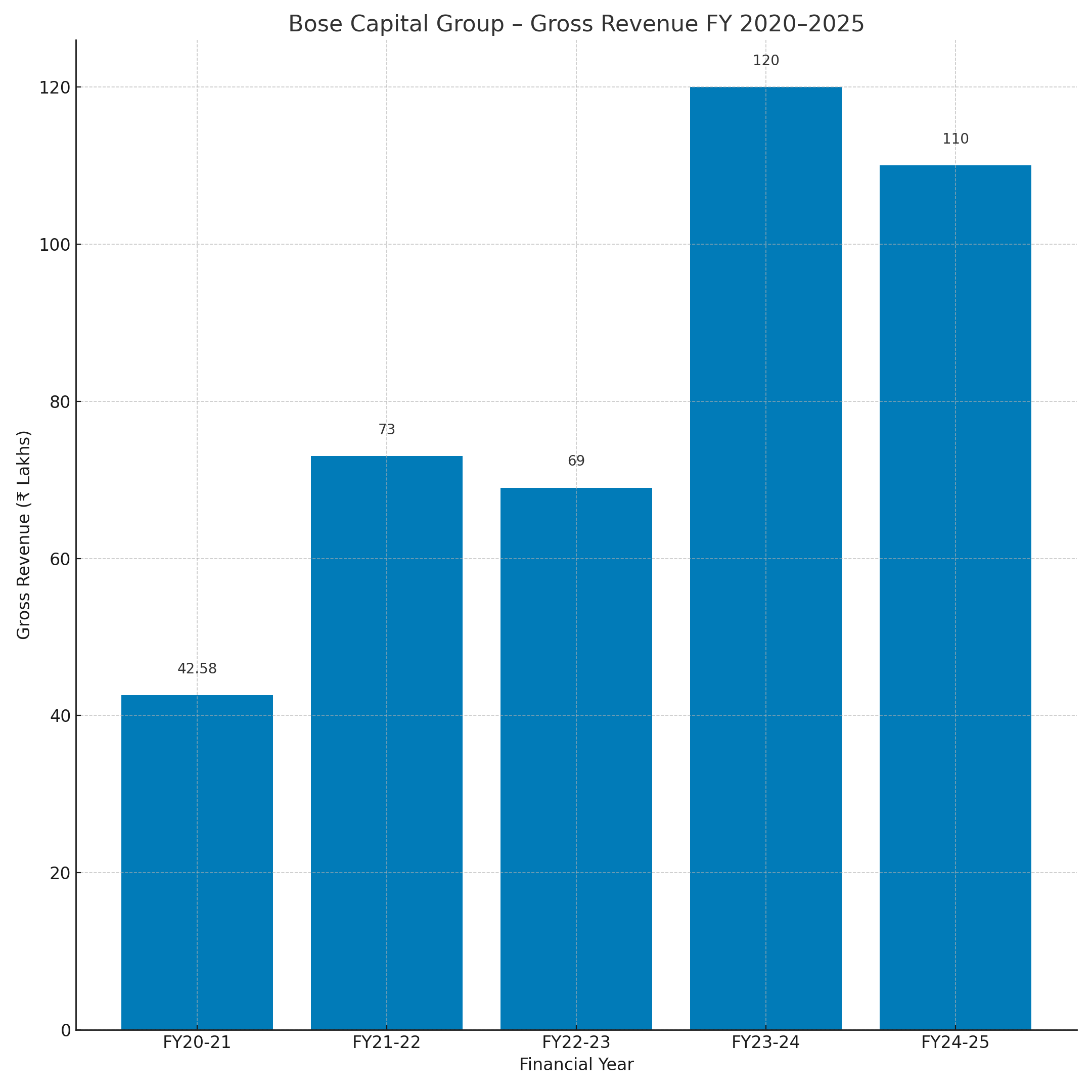

Founded in 2020, Bose Capital Group has expanded from a specialist consulting practice into a multi-region FinTech, Web3, and AI transformation partner.

The group delivers modernization frameworks, digital value-exchange systems, regulatory automation, and data-driven intelligence for institutions across more than 30 countries.

Managing Director

Seasoned mentor and global visionary with a mission to serve the world through better financial solutions.

Chief Executive Officer

Technology architect with strong expertise in AI and blockchain solutions. A global visionary with over 10 years of experience enabling high-performing institutions.

Enterprise-grade blockchain ecosystems enabling verifiable global fund flows.

Digital architecture and modernization for regulated financial institutions.

Resource management platform for funds, teams, compliance, and performance.

Banking Query Management System with structured workflows and audit trails.

Risk, fraud, liquidity, and behavioral intelligence embedded into operations.

Capability development for FinTech, Web3, and AI-driven financial ecosystems.

Inception year focused on enterprise funnel creation and consulting for marquee clients and collaborative networks.

Expansion through global collaborations and multi-country execution models for digital finance.

Shift toward software-driven automation for institutions, NBFCs, and startups.

Platform expansion across micro and macro financial sectors with scalable funnels.

Strategic push into digital-gold ecosystems and allied financial technology plays.

Funding Ask: ₹2.63 Crores INR

Projected Revenue: ₹90 Crores within 36 months

Expansion across AI labs, Web3 infrastructure, digital platforms, enterprise consulting, and global financial operations.

Share a brief overview of your institution and the Bose Capital Group team will propose an aligned FinTech / Web3 / AI roadmap.